With the latest governmental decision, the number of projects in designated rust belt action areas reached 81 in Hungary. Estimated 46 thousand dwellings1 is to be built on these brownfield sites. The sole purpose of this post is to follow these projects and to see how they will or will not help the recovery of the new residential construction sub-market in Hungary.

Status on 28 January 2026.

The upswing has not been too intensive lately, but many XXL projects have moved closer to under construction status.

—

Completed: 3 620 dwellings

Under construction: 10 484 dwellings

Before construction: 26 149 dwellings

Brief background

Rust belt action areas (let me shorten them to rusty) are practically brownfield areas with special benefits. The owner of the site or the developer should initiate the process (with specific development plans) and there is a Committee to examine if the proposed site is entitled for the rusty status. Based on the opinion of the Committee, the final decision is made by the government. The decisions (about the exact sites) are announced in a decree and the special benefits coming with it are:

- priority investment status, meaning e.g. faster permitting procedures2,

- newly built homes can be sold at 5% VAT without limitation in time3,

- this 5% can be reclaimed by the buyers4.

By the current regulations, it means a min. 5% and a max. 27% price advantage over competitors developing on non-rusty area until 2030 (depending on when the permit was obtained) and a 27% price advantage from 2031 on.

Our focus

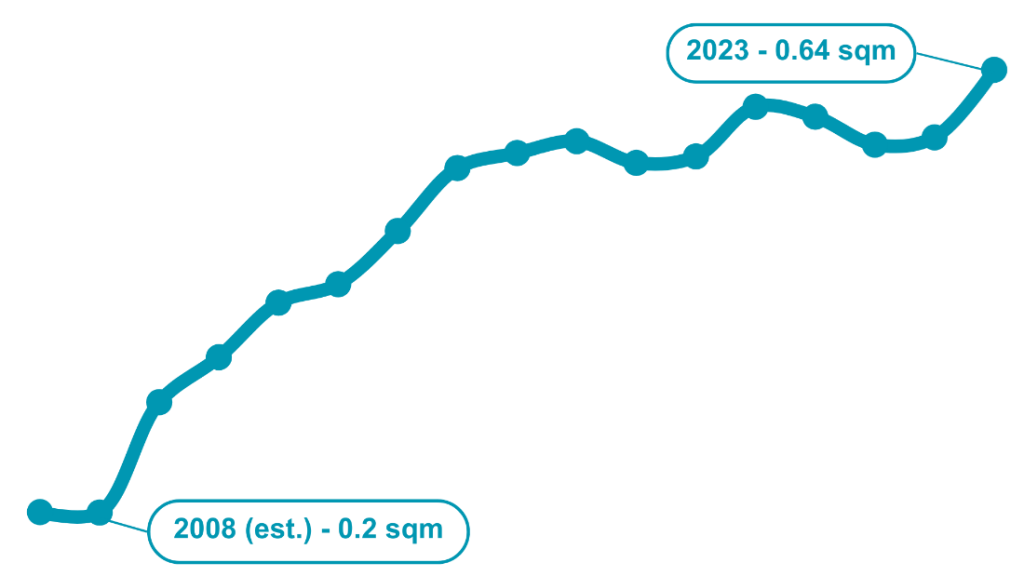

What we do is to turn the mentioned decree into information we need for forecasting. With the help of Eltinga Building Permit Monitor database and the iBuild project information database, actual projects are identified from the lot numbers specified in the decree. Among all the general project specifics, the number of dwellings (where it is known), are attached to these projects.

The map shows the stages of the housing projects that were given rusty status. Bluish dots are those before construction, neon yellow dots are those under construction and the dot disappears once the project is completed.

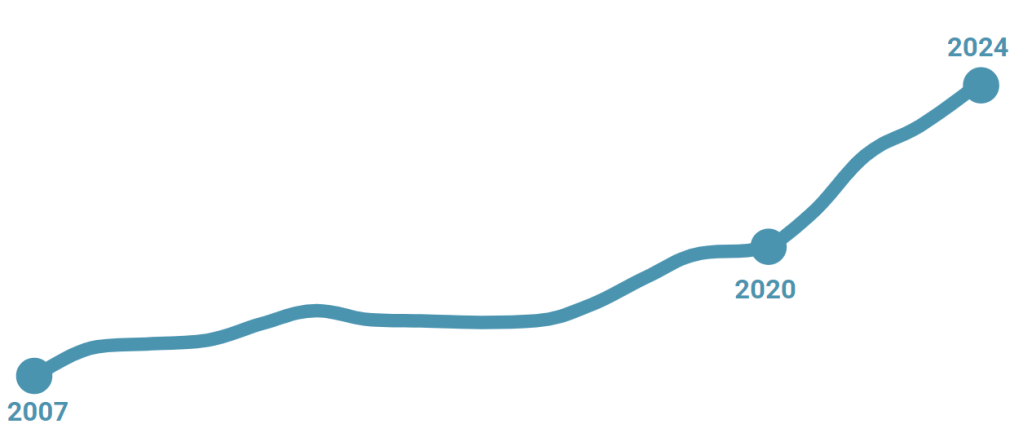

OK, it is very convenient to see projects on a map, but our focus is more on the chart under the map where the yellow is the number of homes under construction.

What we are curious about is if and when the right end of the yellow curve shows a strong upturn.

In other words, we are curious whether the regulation ignites a recovery or not. As of now, it is more common that the yellow line has increased because projects having started in the past were given the rusty status. (So they were just re-qualified, it did not mean new project starts.) In parallel, it is less common that projects start after they were given the status. Just two extreme examples for these: Unipark Buda has been under construction since 2019 and it got the rusty status at the end of 2023, while Láng quarter was given the rusty status in 2021 and it is still before construction.

The charts will be updated quarterly, so check back if you are also curious.

Another way we like to look at it is a list. Here we do not separate the projects to phases (like on the map) and it gives a quick understanding on how each rusty project moves ahead from 1 February 2024 on.

Data sources

The data mostly come from Eltinga Building Permit Monitor (in Hungarian: Építési Engedély Figyelő). This is a very detailed database on before construction multi-unit housing projects in Budapest. It is aiming primarily at developers who would like to understand the competition. For further information on this, please turn to Mr Zoltán Sápi, Eltinga, sapiz@eltinga.hu. Besides, we use the iBuild project information database.

- This is an estimation based on the median size of those rusty projects where the number of homes were announced ↩︎

- 619/2021. (XI. 8.) Korm. rendelet

a rozsdaövezeti akcióterületek kijelöléséről és egyes akcióterületeken megvalósuló beruházásokra irányadó sajátos követelményekről ↩︎ - 2021/8. Adózási kérdés – A rozsdaövezeti lakások értékesítésének adómértéke ↩︎

- Rozsdaövezeti adó-visszatérítési támogatás ↩︎