Press Release on EBI Construction Activity Report Hungary Q3 2022

EBI Construction Activity-Start recorded a sharp falloff in Q3 2022. Between July and September, construction projects started at a value of less than HUF 480 billion – the lowest amount since Q3 2020.

The recent years have seen a considerable price rise in the Hungarian construction industry. In order to filter this out, the analysts of EBI Construction Activity Report compared the value of started construction works at constant prices, using Q3 2022 prices. Based on this, at constant prices, an even greater decline is seen in case of started construction works. In Q3 2022 they have registered their lowest value since 2015. At the same time, thanks to the successful first quarter, the drop was not yet visible based on the figures of the first 9 months, which even at constant prices exceeded the same periods of 2020 and 2021.

EBI Construction Activity Report Hungary analyses the construction industry on a quarterly basis, including the volume of newly started construction works and the value of projects completed in each quarter in aggregate and by segment as well. It is prepared by Buildecon, Eltinga (creation of indicators and development of algorithms for aggregation) and iBuild (project research and project database). The EBI Construction Activity Report Q3 2022 has been released and can be purchased at ebi@ibuild.info.

Value of building construction works down

The decline in Activity-Start witnessed in the construction industry as a whole was observed in building construction, too. The total value of started construction works was around HUF 300 billion, far below the typical first and second quarters. Looking at constant prices, the drop is even more visible. One needs to go back to Q1 2015 to find a lower value than this year’s third quarter. Yet, it is also true in case of buildings that the better first and second quarters pushed up annual figures.

The decrease was also true to residential and non-residential. For the latter, the Activity-Start of EBI Construction Activity Report was around HUF 260 billion, which, at current prices, fell short not only of the figures of the first two quarters, but also of most of the levels of quarters between 2018 and 2021. At constant prices, it was the lowest since Q1 2015.

Building construction projects launched in Q3 2022 included the W-Scope separator film factory in Nyíregyháza, and ParkSide Offices, RTL HQ, Zugló-Városközpont Offices 1 in Budapest. Work also began between July and September on Phase 2 of Campus in Kecskemét, Panattoni Park Budapest City West logistics center in Törökbálint, and the Hungarian University of Agriculture and Life Sciences in Gödöllő.

Yet another downturn in civil engineering

The record registered in Q1 2022 was followed by a minor decline in Civil Engineering Activity-Start in Q2. Q3 brought another drop with roughly HUF 170 billion worth of construction works starting in the subsector between July and September 2022. This, however, did not fall short of the average quarterly figures of previous years. Within civil engineering, road and railway construction works recorded a huge decline. In case of non-road and non-railway construction works, a smaller amount of Activity-Start was measured compared to Q2, which cannot be called low, though.

The biggest civil engineering projects include the elimination of the bottleneck on the Budapest-Kelenföld and Hegyeshalom railway line and several projects related to water network and sewerage network such as the water plant and drinking water quality improvement in Central Transdanubia.

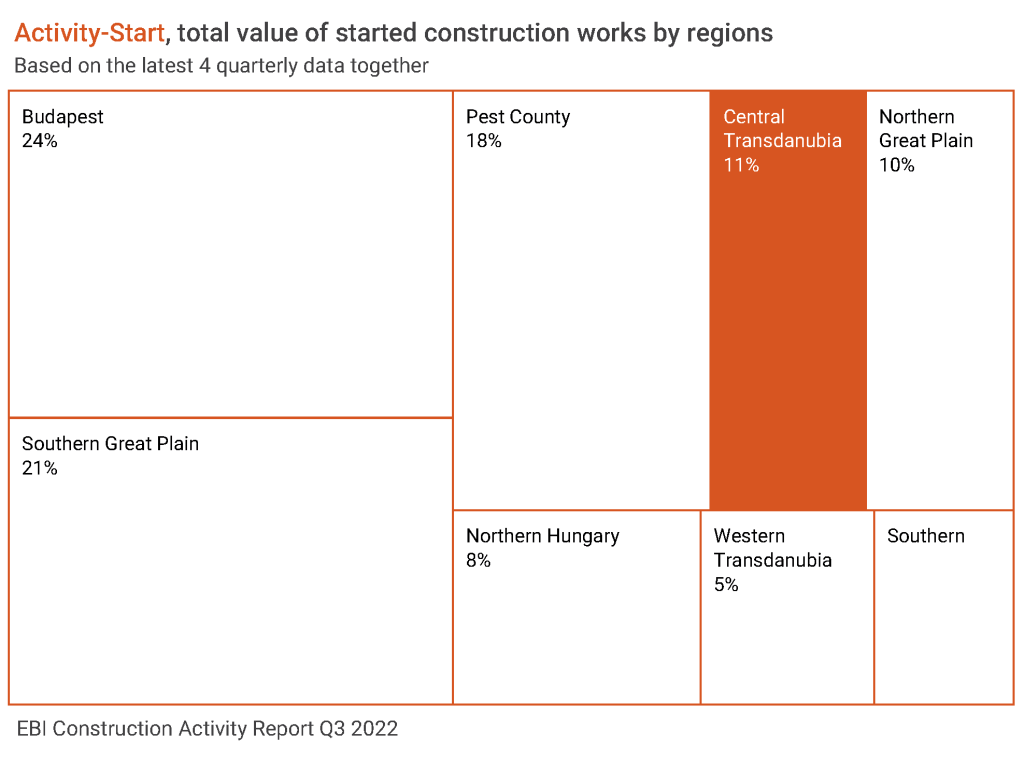

Looking at the last 4 quarters, most construction projects started in Budapest, followed by the Southern Great Plain and then Pest County. South Transdanubia and West Transdanubia were the regions with the lowest value of started construction works.

Very few launched housing constructions

In Q3 2022, the Activity-Start of EBI Construction Activity Report for multi-unit housing construction saw a further decline. Between July and September, construction works started on slightly more than HUF 40 billion, one of the lowest quarterly values in recent years.

The decline in multi-unit construction works is even more noticeable at unchanged prices. Considering previously launched projects, the segment has not witnessed a lower value since Q3 2014. The level of domestic housing construction is low even for the first 9 months of this year. Between 2017 and 2022 only 2020 saw fewer project starts. It is also true, however, that due to the massive increase in construction costs in recent years, an even greater drop can be seen in the volume of multi-unit construction works. At constant price, fewer construction works started only in 2015 than in the first three quarters of 2022.

Project-starts were made difficult by several factors: the uncertain economic climate, the difficult-to-predict prices of building materials and falling demand. Many developers decided to wait and did not start planned projects. The postponement is also supported by the extension of the reduced VAT with two years, so there is no need to rush with the planning or the start of construction either.

After the second quarter, in Q3 2022 the value of completed multi-unit housing projects continued to rise. From the beginning of the year until the end of September, around HUF 200 billion worth of projects reached completion, the same level y-o-y. According to the handover dates published in advance, a further significant value of Activity-Completion is expected for Q4 2022, but the question is how much supply chain issues will hinder completion.

Similarly to previous years, the national distribution of multi-unit residential construction is very uneven. The highest-value-projects continued to start in Central Hungary. Looking at the last 4 quarters, the highest Activity-Start Indicator was linked to Budapest, the second was to Western Transdanubia, while the smallest share was in Pest County and Northern Hungary.

Central Transdanubia

So far, 2022 brought a high Activity-Start in EBI Construction Activity Report in Central Transdanubia. Although the total value of construction works started during 9 months did not surpass the record year of 2021, it exceeded the whole annual Activity-Start of previous years. The total value of works entering construction between January and September 2022 was more than HUF 270 billion. Looking at the past 4 quarters, Activity-Start neared HUF 370 billion in total. The high value of started construction projects is mainly due to the high numbers of building constructions where Activity-Start in the last 4 quarters was close to HUF 300 billion, despite Q3 already brought much more moderate project launches.

The value of launched multi-unit home construction projects in the region fell sharply in Q3 2022. In the last 4 quarters it was around HUF 15 billion, so its share in the national Activity-Start was only 4%. The region saw a peak in such projects starts in 2018-2019 when Green Resort Balatonfüred, Prémium Residence Kenese Liget (Balatonkenese), and Pelso Bay Apartments & Yacht Club (Alsóörs) began. Building permit numbers were high in 2022, with more permits issued in the first 9 months of this year than in the same period in the years prior to 2021. But the question is when these permitted projects can start given the difficulties affecting the segment.

For non-residential buildings, Central Transdanubia recorded a very low value of started projects in Q3 2022. At the same time, thanks to the good first two quarters, this year’s Activity-Start indicator might actually be high as it has already exceeded the whole 12-month level of previous years (except for the record year of 2021). Construction started on the following projects: Kovács Katalin National Kayak-Canoe Sports Academy (in Sukoró); Phase 3 of Volta Energy Solutions Hungary copper foil factory (in Környe); ActiCity Event Center (in Veszprém).

In civil engineering, although 2021 saw a drop, and the first two quarters of this year also registered low figures, the third quarter’s high Activity-Start value pushed 2022 figures upwards. For example, this year saw the start of works on the Budapest-Kelenföld and Hegyeshalom railway stretch and several water and sewerage projects in the region.