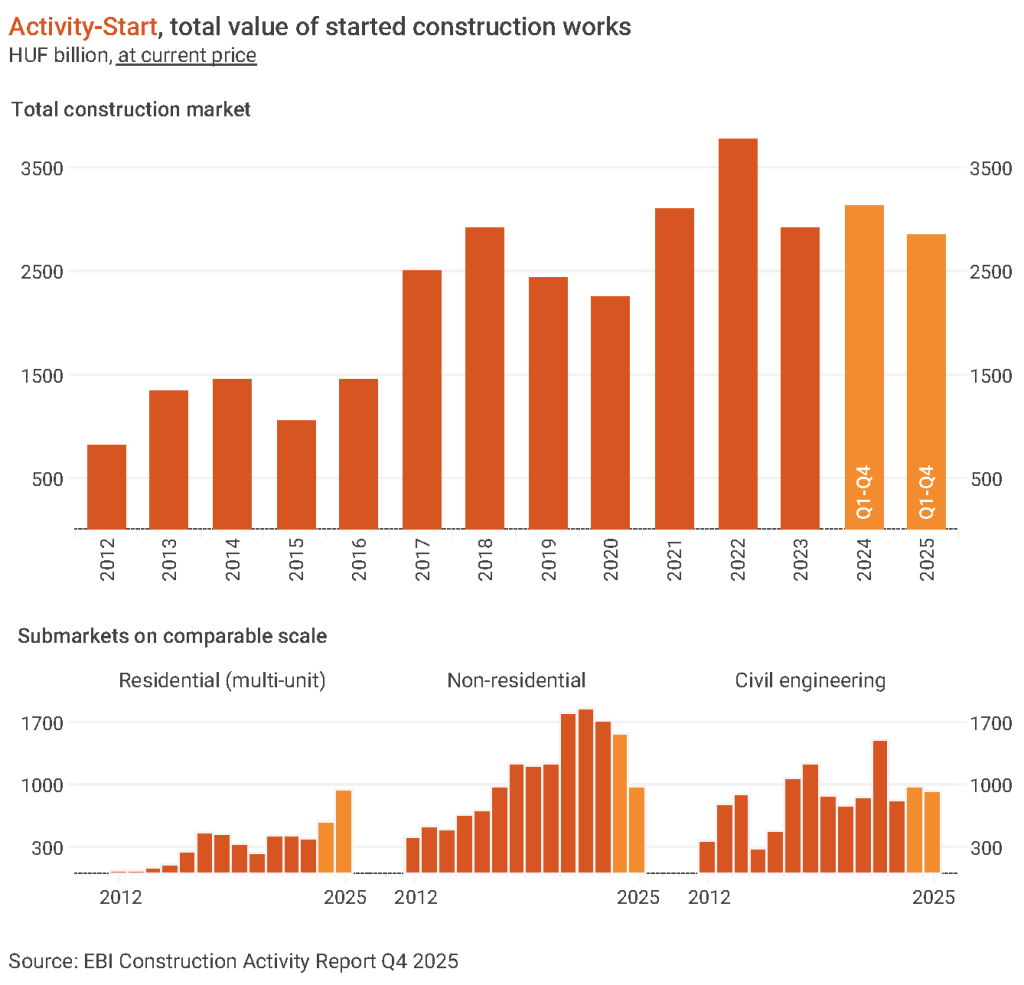

The latest EBI Construction Activity Report has found that although the expansion of M1 motorway caused a considerable surge in the value of started construction projects in Q3 2025, Q4 brought very low Activity-Start. Even at current price, such a low number of construction projects did not start in a quarter in the past 9 years. However, thanks to the high numbers in Q3, annual Activity-Start only slightly sank against 2024. In total, projects worth nearly HUF 2,900 billion entered construction phase in 2025.

EBI Construction Activity Report Hungary analyses the construction industry on a quarterly basis, including the volume of newly started construction works and the value of projects completed in each quarter in aggregate and by segment as well. It is prepared by Eltinga, Buildecon (creation of indicators and development of algorithms for aggregation) and iBuild (project research and project database). To obtain the report, please contact us.

Declining Activity-Start in building construction in Q4 2025

In Q4 2025, Activity-Start in building construction decreased significantly compared to previous quarters. However, due to the higher first quarter value, the full-year decline remained 10% compared to 2024, while the decrease was 8% over 2023.

Overall, construction works started in the segment last year were worth slightly less than HUF 2,000 billion, the lowest level between 2021 and 2025. Due to the significant increase in multi-unit residential construction in 2025 and the few construction starts in non-residential buildings, multi-unit residential construction accounted for almost half of building construction Activity-Start, which has not been the case since the first half of the 2000s.

Non-residential construction was characterized by a decline in Q4, and the value of started construction works was roughly at the same level as in Q2, which was also modest. For the year as a whole, non-residential Activity-Start was around HUF 1,000 billion, the lowest value in the period between 2018 and 2025. It also shows a 37.5% decline compared to 2024 at current price, and a 43% drop over 2023.

The largest non-residential projects entering construction phase in Q4 2025 included the construction of several logistics centres, such as CATL warehouse in Debrecen, Porsche Parts Center logistics-warehouse centre in Budaörs, and Building C of VGP Park Budapest Aerozone. Several hotel projects began, too, including the construction of Mama Shelter Hotel and Ruby Hotel in Budapest, and Danubius Hotel Annabella ***Superior in Balatonfüred.

M1 highway expansion boosting civil engineering Activity-Start in 2025

Following Q3 2025, which registered high Activity-Start due to the expansion of M1 motorway (M0-Concó rest area), Q4 2025 saw a very low value of started civil engineering works in Hungary. Few projects started not only in value, but also in number.

Thanks to the motorway project, annual figures tell a nicer story with projects starting in the value of nearly HUF 1,000 billion in 2025. It did not differ much from 2024, although the figures then were also boosted by the start of one large project, the construction of the Mohács Danube Bridge and related road network. Overall, in 2024-2025, apart from these two large projects, the value of civil engineering projects entering construction phase would have been very moderate. In Q4 2025 not a single project made it to the list of biggest started ones, indicating the reduction in civil engineering in that quarter.

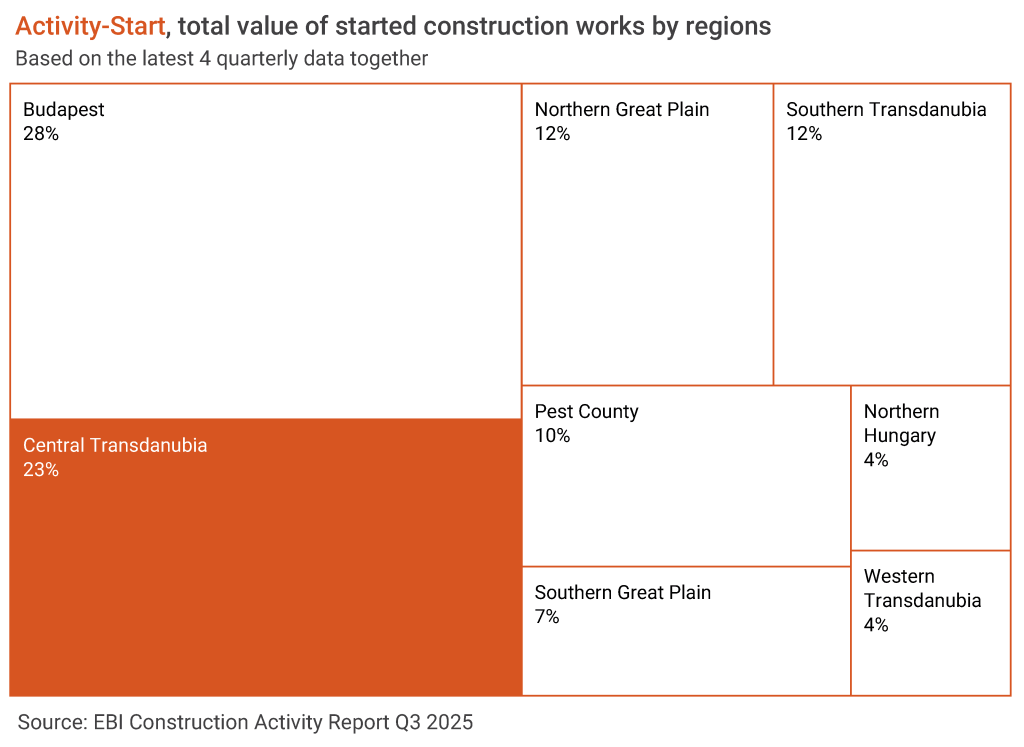

Budapest continues to lead Activity-Start

Budapest had the highest share, 31%, within total Activity-Start in the last four quarters. Central Transdanubia also had a high proportion, more than 27%, primarily due to the M1 highway expansion. Together, more than 40% of works started in Central Hungary, 36.4% were related to Western Transdanubia, while the share of Eastern Hungary was 23%.

Sluggish multi-unit residential developer activity in Q4 2025

Q4 2025 saw another decrease in the value of started multi-unit residential constructions, with the cost value of started works falling below the level of Q2-Q3 2024, the second lowest value in the past two years.

However, 2025 overall was still a record year thanks to the high activity in the first 3 quarters of the year. Works worth nearly HUF 1,000 billion started, exceeding the Activity-Start of the previous year by 60% even at current price. At constant price, it was roughly equivalent to the record holder years of 2017-2018.

2026 may also register strong multi-unit residential construction as last year’s preliminary data shows surge in building permits. Further boost may come from the Otthon Start Program which was launched in September 2025 (subsidy helping first-time homebuyers secure up to HUF 50 million in mortgage financing with a fixed 3% interest rate and a maximum 25-year term) and the Capital Program, which was also started last year. In connection with the former, the construction of several thousand units has been announced in priority projects, and applications for several thousand more may be given green light. Since sales deadlines must also be met in priority projects, their start is expected soon with many construction works beginning this year.

The weaker project start in recent years was also visible in the Activity-Completion indicator in 2025. Multi-unit homes worth a total of HUF 370 billion were completed last year, roughly 8% below the 2024 value.

Regionally, in the past 4 quarters, most multi-unit residential Activity-Start was related to Budapest with 68% of works starting here in 2025. Central Hungary, including the capital city, accounted for 70%. 16% of works started in Western Hungary and 14% in Eastern Hungary.

Moderate wholesale and retail Activity-Start in Q4 2025

The last time an outstanding Activity-Start was registered in wholesale and retail was in 2017 and 2021-2022. In 2017 the start of construction of Etele Plaza contributed with the highest value, while in 2022 two big project starts played a major role in higher numbers (ActiCity Event Center in Veszprém and Phase II of Zenit Corso shopping centre in Zugló).

2025 brought a rather modest Activity-Start in wholesale and retail, works started by a 27% lower value than in 2024. The decline compared to 2023 was also 16%, roughly at the level of 2020, and the shrinkage compared to the peak years (2017 and 2021-2022) was 39-50%. Despite the drop, larger projects began last year, such as OBI DIY store and Drive-in in Kistarcsa and Stop Shop in Salgótarján.

In 2025, a total of HUF 71 billion worth of wholesale and retail properties were completed, the same as in 2024, for example, the shopping court in Táncsics Mihály Street in Komárom, Phase I of Time Out Market in Budapest, Mömax home improvement store in Székesfehérvár, and Spar store and Dera Park shopping park in Szentendre.

Original article: Tünde Tancsics (ELTINGA); English version: Eszter Falucskai (Buildecon)